Opening Bank Account With Multiple IBANs

- Epico Finance

- Feb 13, 2024

- 6 min read

Updated: Aug 19, 2025

In today’s globalized economy, cross-border financial management is no longer optional but essential. From SMEs engaged in international trade to digital nomads and investors seeking to diversify assets, the need to handle multiple currencies efficiently is growing rapidly.

According to the World Bank, global cross-border payments are expected to reach $250 trillion annually by 2027, with businesses driving the majority of this volume. For individuals and companies alike, traditional banking systems often mean juggling multiple accounts, facing high FX fees, and dealing with slow settlement times.

A practical solution that has emerged is opening a multi-IBAN business or personal account, which allows seamless management of funds across currencies and regions from a single platform. This article explores the benefits, challenges, and steps to set up such an account, highlighting why multi-IBAN banking is becoming a cornerstone of modern financial management.

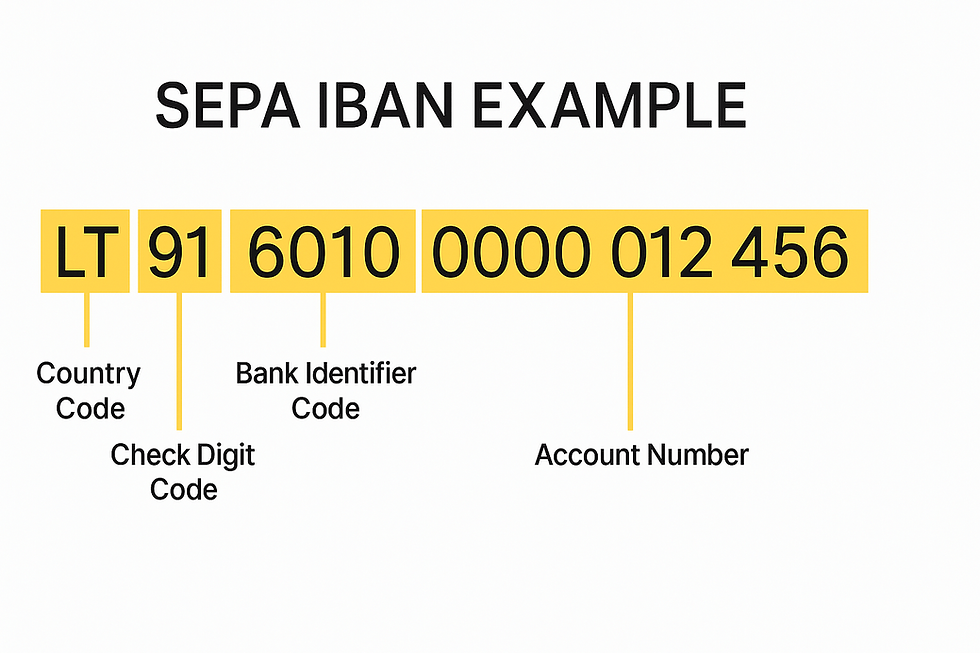

The Basics Of IBAN

An International Bank Account Number (IBAN) is a standard international numbering system developed to identify bank accounts across countries. The purpose of the IBAN is to facilitate the processing of cross-border transactions with reduced risk of transcription errors. Each IBAN is unique to your account and includes information such as country code, check digits, bank identifier, and account number.

Advantages of Having Multiple IBANs

1) Simplified international transactions. Holding local IBANs per market (EUR/SEPA, GBP/FPS, USD/ACH) lets you invoice and get paid in local currency—often without FX at receipt—so funds arrive faster and cheaper than cross-border SWIFT. With SEPA Instant’s 10-second, 24/7 rule coming into force across the EU in 2025, euro collections and payouts clear in real time; the UK’s Faster Payments already supports instant GBP up to £1m. That speed and “local feel” also boosts payer confidence (many counterparties prefer paying a local account versus an overseas IBAN).

For example: A German SaaS bills French and Dutch customers to FR/DE IBANs via SEPA; refunds and chargebacks settle instantly, with no correspondent bank fees.

2) Enhanced financial control and lower costs. Multiple IBANs let you segment cash by country, product, or marketplace seller, improving reconciliation and audit trails (e.g., one IBAN per region or per major client). Local rails are typically cheaper than cross-border options: the ECB notes one-third of retail cross-border payments still take >1 business day and many corridors cost >3%, whereas domestic/instant rails cut both time and fees. UK fee schedules show Bacs at ~£0.20–£0.50, Faster Payments ~£1–£3, versus premium CHAPS fees—illustrating the benefit of routing domestically where possible.

For example: A UK marketplace assigns virtual IBANs to each seller; incoming GBP via Faster Payments auto-reconciles to the seller’s ledger, slashing manual matching.

3) Optimized for multi-market businesses. Local IBANs improve conversion and credibility—customers pay a familiar account format, suppliers receive their own currency without forced FX, and finance teams can choose when to convert at better rates.

For example: A UK→SG supply chain pays SGD invoices from a local SGD account (via a provider’s Singapore rail) instead of sending a GBP→SGD SWIFT; FX is executed in bulk weekly at tighter spreads, cutting total costs by >1%.

Bottom line: Multi-IBAN banking turns cross-border operations into local ones—accelerating settlement, reducing fees, improving reconciliation, and giving you strategic control over when and where you take FX.

Considerations Before Opening a Multi-IBAN Account

1) Banking regulations and compliance. Each jurisdiction applies its own rules on foreign accounts, capital controls, and reporting obligations. For example, in the EU, firms with cross-border IBANs must comply with PSD2/Open Banking requirements, while in the US, maintaining non-resident accounts may trigger FATCA reporting. Failure to navigate these obligations can lead to fines or account closures—over 30% of SMEs cite compliance burdens as a barrier to opening cross-border accounts.

A practical step is to work with providers that specialize in multi-IBAN issuance across regulated hubs (e.g., Lithuania, Luxembourg, or Ireland), where frameworks are more crypto- and fintech-friendly.

Example: A Cyprus-based e-commerce seller opening a German DE-IBAN via a regulated EMI gains local SEPA access while remaining compliant with both Cypriot and EU cross-border rules.

2) Fees and charges. While multi-IBAN accounts reduce FX costs, providers may add monthly maintenance fees, per-IBAN charges, or tiered transaction fees. For instance, some EMIs charge €10–€20 per IBAN/month beyond a base allocation, while FX spreads vary from 0.2% to over 2% depending on corridor liquidity. Reviewing these costs is crucial for SMEs where margins are thin. A best practice is to simulate expected transaction volumes across corridors (USD→EUR, GBP→SGD, etc.) and benchmark providers against those flows.

Example: A UK consultancy invoicing in USD, EUR, and GBP found one EMI’s FX markup of 0.35% yielded annual savings of £25k compared to its traditional bank at 2.1%.

3) Bank or EMI selection. Reputation and technology stack matter as much as price. Look for providers with real-time API connections, support for virtual IBAN allocation, and responsive customer service. Challenger banks and EMIs allow instant IBAN creation under one dashboard, whereas legacy banks may take weeks. If you’d like an updated list of banks and EMIs offering multiple IBANs under one platform, we can provide it upon your request.

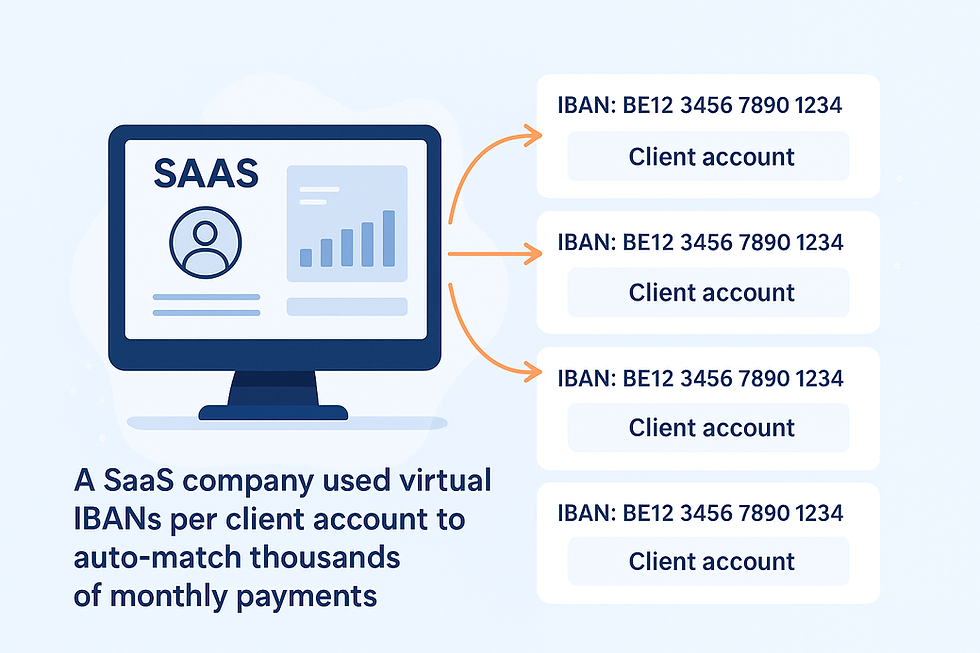

Example: A SaaS company operating across Europe used virtual IBANs per client account to auto-match thousands of monthly payments, reducing reconciliation time by 80% and eliminating human error.

Steps To Open A Bank Account With Multiple IBANs

1. Research The Selected Bank: Start by checking for the reviews online or even going through their website and familiarizing with the whole service package. International banks and digital banks often provide these services tailored to globetrotters and international businesses, therefore you might find more than just multiple IBANs and payments.

2. Understand the Requirements: Once you’ve done your research, familiarize yourself with their account opening requirements. These may include identification documents, proof of address, business description (or a plan if it’s a start-up), example invoices, existing bank account statements and so on.

3. Application Process: Apply for the account either online, through the bank’s online platform, or in person, depending on the bank’s process. Provide all necessary documentation and information requested by the bank and be prepared to answer follow-up questions.

Application process can take anywhere from a week to a month, depending on the complexities of your business and its structure. Moreover, bank re4presentatives might ask several rounds of follow-up questions and being swift in answering is key.

4. Set Up Your IBANs: After your account is approved, you can request multiple IBANs associated with it. Specify the currencies and countries for which you require an IBAN. Keep in mind, that there is no such bank that can provide you with all possible IBANs, therefore researching and finding out which IBANs will be available to you is of high importance.

5. Activate And Use Your Account: Once everything is set up, activate your account according to the bank's instructions. Start managing your finances across borders more efficiently. We also suggest to ask for relationship manager, that will be always there to assist with your account matters.

Digital Banking And The Future Of Multiple IBANs

Digital banking has revolutionized global finance by making multi-currency management faster, cheaper, and more accessible than ever before. Today, many challenger banks and fintechs allow businesses to open multi-currency accounts with multiple IBANs, all managed through a single digital interface. According to McKinsey’s 2024 Global Payments Report, over 65% of SMEs in Europe now rely on digital-first providers rather than traditional banks for international payments, citing lower fees and better transparency as key advantages.

Beyond convenience, these platforms increasingly incorporate advanced tools such as virtual IBANs per client account, which automate reconciliation and reduce operational costs.

Looking ahead, the lines between traditional banking and digital assets are blurring. Some digital banks now support crypto on/off ramps, stablecoin settlements, and even interest-bearing accounts for fiat and digital balances, enabling businesses to optimize liquidity across both ecosystems. For instance, several European EMIs already allow companies to hold EUR, USD, GBP, alongside USDC or USDT, giving them flexibility in supplier payments and treasury management.

With the tokenization of money and payments projected to reach $5 trillion by 2030 (Boston Consulting Group, 2023), digital banks offering multi-IBAN functionality alongside crypto rails are likely to become the new standard for global business banking.

Conclusion

By carefully selecting a banking partner and understanding the associated requirements and fees, individuals and businesses can greatly benefit from the convenience and functionality that multiple IBANs bring to the table.