Opening Bank Account For Crypto Payments: A Comprehensive Guide

- Epico Finance

- Feb 3, 2024

- 5 min read

Updated: Sep 2, 2025

If you are looking to open bank account that also allows to make crypto payments than keep reading on.

There are an estimated 420 million cryptocurrency users worldwide and approximately 30,000 merchants already embracing Bitcoin and other digital currencies, the trend towards crypto payments is unmistakable. Brands like Subway, Starbucks, BMW, and Microsoft are leading the way, demonstrating the vast potential for businesses to tap into new markets, especially in areas where access to traditional banking is limited.

Understanding Bank Accounts and Crypto Payment Integration

Before opening a bank account that supports crypto-related payments, it’s important to understand how traditional banking connects with cryptocurrency transactions. While merchants and businesses may accept digital assets like USDT or Bitcoin, settlement into fiat accounts is still essential for covering operational costs, payroll, and supplier invoices.

This is where crypto payment providers and banking partners work together: the provider processes incoming digital payments, manages conversion to fiat at competitive rates, and then credits the business’s bank account via SEPA, SWIFT, or local payment rails. For businesses, this setup combines the efficiency of crypto payments (instant, borderless transfers) with the stability and compliance of traditional banking.

Why Businesses Need a Crypto-Friendly Bank Account

Even with modern crypto payment gateways simplifying the acceptance of digital assets, businesses ultimately need a bank account that can seamlessly handle the conversion and settlement of crypto into fiat currencies like EUR, GBP, or USD. This is where many companies face friction. Traditional banks often remain cautious — or outright resistant — to working with crypto-related businesses due to perceived risks. In fact, a 2024 Deloitte survey showed that over 60% of SMEs operating with digital assets had difficulty securing reliable banking partners. Without the right account, companies risk delayed settlements, high fees, or even sudden account closures.

By contrast, a crypto-friendly bank or electronic money institution (EMI) understands the flow of crypto-to-fiat transactions, supports payment rails such as SEPA Instant or Faster Payments, and provides the compliance infrastructure (e.g., safeguarding accounts, transaction monitoring, clear audit trails) that regulators demand.

How To Choose The Right Bank For Crypto Payments?

When searching for a bank to support your crypto transactions, consider the following factors:

Crypto-Friendly Policies: Opt for banks with explicit policies supporting cryptocurrency transactions. Make sure the selected bank has on-ramp and off-ramp capabilities, so that you can convert back into any major fiat currency and vice versa. Also, consider their ability to transact in fiat currencies using traditional payment methods such as SEPA, SIWFT, ACH and so on. Besides payments and FX, you might want to have individually named IBANs to avoid nested or pooled accounts.

Regulatory Compliance: Ensure the bank adheres to stringent regulatory standards, which is indicative of their commitment to security and legal compliance. Even better, is the chosen financial institution has multiple licenses in multiple countries. It will give you confidence that their business is run properly and is strictly supervised.

International Operations: For businesses targeting global markets, banks with international operations and currency exchange capabilities are preferable. Moreover, you might want to consider not only regular spot FX but also hedging instruments and strategies to optimize your treasury operations.

If you would like us to send you an up to date list of crypto friendly banks and crypto payment gateways that fit the above criteria, fill out our contact form.

Setting Up Your Bank Account

Once you've identified a suitable bank, the process of setting up an account involves several key steps:

1. Documentation and Compliance: Be prepared to provide comprehensive business documentation, including licenses, proof of compliance with regulatory requirements, and detailed information about your business operations.

2. Understanding the Fees: Familiarize yourself with the bank's fee structure for cryptocurrency transactions, including any conversion fees or transaction charges. You might want to provide some details about your operations and volumes in order to get tailored commercials instead of general pricing.

3. Integration with Payment Gateways: Ensure that the bank account can be seamlessly integrated with your chosen cryptocurrency payment gateway. This facilitates smooth transactions and settlements.

If you are not sure about anything from above or want to ask some questions, get in touch with us and we will be glad to help.

Leveraging Cryptocurrency Payment Processors

In conjunction with a crypto-friendly bank account, selecting the right cryptocurrency payment processor is vital. These processors offer tools and services to integrate crypto payments into your business seamlessly. They handle the technical aspects of transactions, including the instant conversion of cryptocurrencies to fiat, thereby mitigating the volatility risk associated with digital currencies.

Even better if you can find a financial institution that can do both via a single integration point and banking platform. Once again, we would be happy to share some banks that have both solutions under one roof, just send us an email.

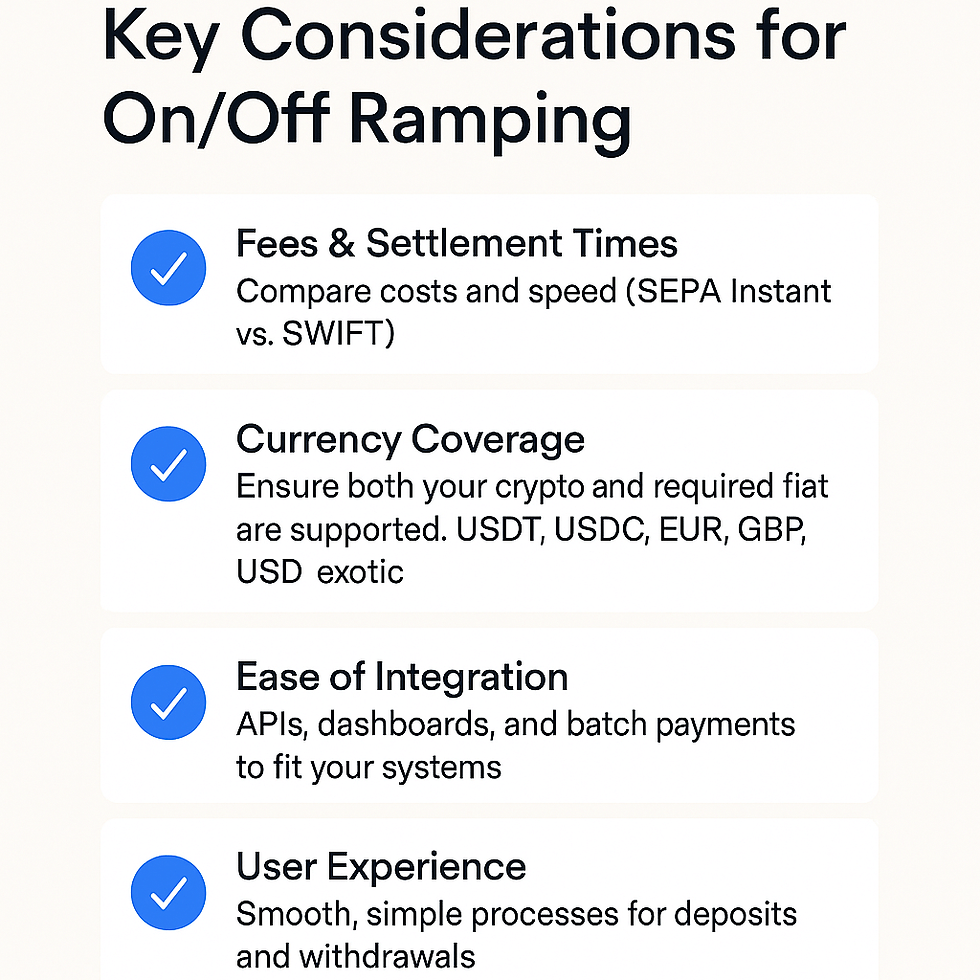

Key Considerations for On/Off Ramping

For businesses handling digital assets, one of the most critical operational decisions is how to on-ramp (convert fiat to crypto) and off-ramp (convert crypto to fiat) securely and efficiently.

Fees and Settlement Times: Understand the total cost of conversion across different providers. This includes trading spreads, transaction fees, and bank transfer charges. For example, centralized exchanges may charge 0.1%–0.3% per trade, while OTC desks offer tighter spreads for larger volumes.

Equally important is settlement time: does EUR, GBP, or USD arrive in your bank within minutes via SEPA Instant or Faster Payments, or does it take several days through SWIFT? Mapping these factors to your business needs (e.g., payroll cycles, vendor payments) ensures smoother operations.

Coverage of Fiat and Crypto Currencies: Not all ramps support every corridor. Some specialize in major pairs like USDC→EUR or USDT→USD, while others enable exotic currencies. Before committing, verify that your ramping partner can handle the specific corridors and volumes your business relies on. For instance, a London-based OTC desk may efficiently handle GBP→USDT, but you may need an EU-based EMI for reliable EUR payouts.

Ease of Integration and Operations: On/off ramping should align with your existing systems. Look for providers offering API connections, batch payment tools, and treasury dashboards so your finance team can reconcile transactions without manual work. This reduces operational overhead and minimizes reconciliation errors. For businesses scaling quickly, automation is a must.

Customer and End-User Experience: If your business directly serves end-users (e.g., paying customers or employees), the ramping process must be frictionless. End users should be able to deposit or withdraw with minimal steps, clear instructions, and confidence in transaction speed. Poor user experience can undermine trust and create support burdens.

Compliance and Reliability: always evaluate how providers handle compliance and regulation. Off-ramping inevitably involves bank transfers, and regulators demand strict AML/KYC procedures. Partnering with regulated entities such as licensed EMIs, banks, or registered crypto-asset firms reduces the risk of frozen funds or rejected payments. Reliable customer support is equally important — you need a partner that can resolve issues quickly and provide audit-friendly transaction records.

Conclusion

In conclusion, setting up a bank account for crypto payments is a pivotal step for businesses aiming to leverage the burgeoning cryptocurrency market. By carefully selecting a crypto-friendly bank and integrating a reliable cryptocurrency payment processor, businesses can capitalize on the benefits of digital currencies while ensuring compliance and operational efficiency.