Opening Bank Account For Family Office [Global Guide]

- Epico Finance

- Mar 25, 2024

- 6 min read

Updated: Aug 5, 2025

Popularity of family offices, serving ultra-high net worth individuals and families, are growing as much as the desire for direct control over financial and investment decisions of generational wealth. This transition underscores the importance of selecting the right banking partner, one that aligns seamlessly with the unique needs and aspirations of a family office.

Understanding Family Offices

The migration towards family offices reflects a preference for in-sourcing capabilities such as strategic asset allocation, risk management, and financial reporting, over the conventional reliance on private and investment banks that were popular in the past few decades.

This trend has spurred the adoption for digital banking services, especially those that are tailored to family offices. This backdrop sets the stage for understanding how to navigate the banking sector in establishing or optimizing a family office's banking arrangements.

Most Popular Jurisdictions for Family Office Setup and Banking Challenges

Some of the most popular jurisdictions for setting up a family office include Singapore, Switzerland, the UAE (particularly Dubai), the United States, and the United Kingdom.

These regions are favored for their robust legal frameworks, favorable tax environments, political stability, and access to global financial markets.

Singapore is known for its efficient regulation and attractive tax incentives, while Switzerland offers a long-standing reputation for wealth management and privacy. The UAE provides zero-tax benefits and strategic geographic access to Europe, Asia, and Africa.

However, setting up a family office in these jurisdictions also comes with banking challenges—such as complex compliance requirements, heightened due diligence for cross-border structures, and strict AML regulations. In some cases, non-resident or high-net-worth family structures may face delays in onboarding or maintaining bank accounts due to increased scrutiny from regulators.

Evaluating Banking Needs For A Family Office

Internal Management and Asset Structure: The operational scope of a family office, encompassing investment management, administrative support, and advisory services, dictates the complexity and breadth of banking services required. Understand the operational nuances of an individual family office determines the banking needs, ranging from securities trading to transactional banking for asset purchases or sales, currency conversion or even hedging.

Core Competencies of Banking Providers: Selecting a banking partner demands a meticulous assessment of a bank's core competencies, including its track record in servicing family offices, the expertise of its dedicated relationship managers and dealers, and the depth of its digital infrastructure, especially if the family office has high volume of transactions or is dealing with crypto currencies.

Once the requirements are clearly defined, next step is choosing the right banking partners. There are many digital and traditional banks that cater to family offices, however each jurisdiction has its own nuances that may impact the account opening process. If you would like to get an up to date list of banks that cater to family offices based on your current or preferred jurisdiction, fill out our contact form and we will send it to you by email.

Regulatory Considerations: Navigating AML and KYC regulations is highly important. A clear understanding and preparation for these regulatory requirements streamline the onboarding process, reinforcing the security and integrity of the banking relationship. What is more unique to family offices is the source of funds that are being managed or potentially transferred in or out of the newly opened bank account. Especially banks in the EU or UK, are strict about identifying UBOs and the source of wealth, sometimes asking for supporting documents or bank statements.

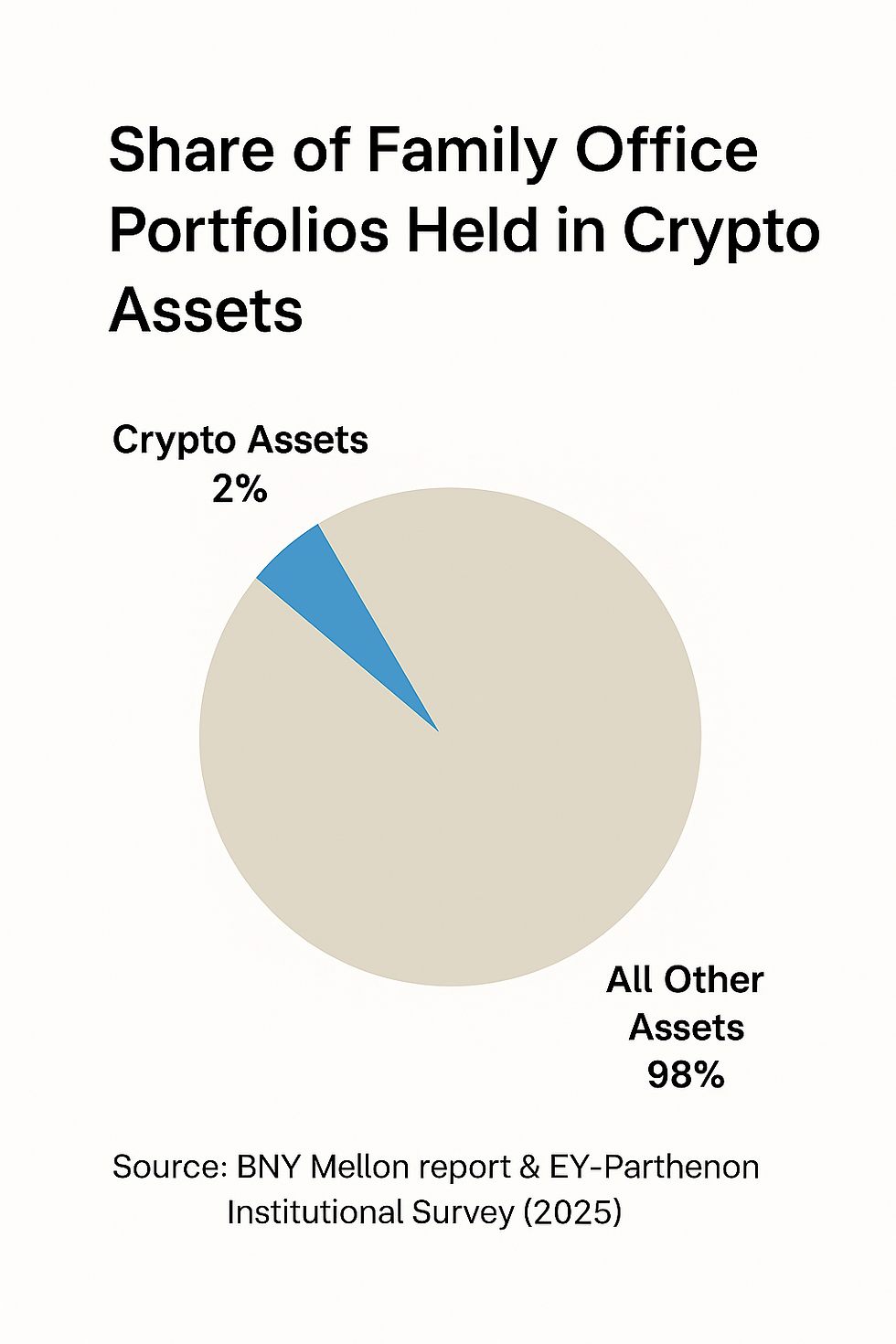

Crypto Element: Today’s family offices are often exploring ways to incorporate digital currencies in their asset or payment strategies. As there are still a very low number of traditional banks allowing transactions to or from crypto exchanges, digital banks are quickly adapting and filling the need for fiat bank account that can be used for operational purposes when it comes to crypto exchanges. Contact us for a list of crypto friendly banks.

Steps To Opening A Bank Account For A Family Office

1. Market Research: Begin with a thorough market analysis to identify banks that have a dedicated family office service team and a proven track record in addressing the specific needs of family offices. Once again, you may drop us a message to get an up to date list of such banks.

2. Banking Service Evaluation: Evaluate a potential bank’s service offerings: understand their digital capabilities such as banking platform, mobile app or API integrations, payment capabilities such as payment methods, available currencies for incoming or outgoing payments, customer service, relationship management and direct access to dealing/trading desk, their rates for transactions or any additional fees such as monthly fee or payment cancellation fee.

3. Regulatory Compliance: Prepare for regulatory compliance by gathering documentation needed for onboarding for new bank account. Usually banks ask for regular corporate identification documents, however be prepared for enhanced due diligence questions where you may be asked for supporting contracts or invoices, bank statements or video identification calls.

4. Initial Engagement and Account Opening Application: Engage with the bank to initiate the account opening process. This step typically involves a detailed discussion about the family office's needs, expectations, projected volumes of transactions and the submission of an application accompanied by required documentation.

5. Ongoing Management: Once the account is opened, establish a framework for ongoing communication and relationship management with the bank. This ensures the continuous alignment of evolving needs of the family office and smooth transactions.

What Your Family Offices Should Seek From Banking Providers

Family offices demand a banking partner that offers not just financial services but a partnership that resonates with their long-term vision and unique needs. Key expectations include:

- A Customer-Centric Approach: Banks must demonstrate an understanding of the family office's unique needs, offering personalized services that go beyond generic financial products. Often, an add on from banks is a relationship manager that is available via phone or email during the business hours and sometimes beyond. A dealer that is always there to consult and suggest best execution strategies and lowest spreads.

- Long-term Partnership: Family offices are established with a generational perspective, requiring banking partners to support long-term goals, including succession planning and legacy building.

- Advanced Technology: Engagement with banks that leverage advanced technology for efficient account management and robust cybersecurity measures is increasingly important. Moreover, some family offices are looking to integrate their back offices systems with APIs or automate their transactions, therefore a good banking partner should have that available too.

FAQ: Bank Account Opening for Family Offices

Q1: Can a family office open a bank account like a normal business entity?

Yes, but with stricter requirements. A family office typically opens accounts as either a trust, holding company, or foundation. Banks will conduct enhanced due diligence due to the wealth involved and the complex tax structure.

Q2: Which banks are best for family office accounts?

Top-tier private and wealth management banks are preferred. Popular banking jurisdictions are: Switzerland, Singapore, and Dubai.

Q3: What are the main challenges when opening a family office bank account?

Source of funds scrutiny and wealth legitimacy, complex ownership structures involved in the corporate set-up, lack of transparency, especially for the UBO's involved, residency miss-matches.

Q4: Can a newly set-up family office open a bank account immediately?

It depends. Some banks require 6–12 months of operational history. However, if the UBO is well-known, has previous banking relationships, and provides full transparency, some private banks will open accounts during the setup phase—especially in Singapore, Switzerland, or the UAE.

Q5: Are offshore jurisdictions like BVI or Cayman still suitable for family office banking?

These are still used for holding companies, but opening bank accounts in offshore jurisdictions has become more difficult due to global de-risking and AML pressure.

Q6: How much capital is needed to open a family office bank account?

Private banks usually require $1M–$5M minimum deposit, but multi-family offices and boutique banks may have lower thresholds. Retail or commercial banks have easier entry but offer limited services compared to private banks.

Q7: Can family offices use fintech or digital banks?

Yes. Some fintechs are well adapted for the complexity of family office structures.

Conclusion

Opening a bank account for a family office is a critical step that requires careful consideration of the bank's alignment with the family office's operational, strategic, and regulatory needs. By focusing on the bank's customer-centricity, digital infrastructure, and ability to cater to the unique requirements of family offices, you can establish a banking partnership that supports your financial objectives and legacy aspirations.