Opening a Euro (EUR) Account for a UAE Company: What You Need to Know

- Epico Finance

- May 10, 2025

- 3 min read

Updated: Jun 26, 2025

As the UAE continues to grow as a global business hub, many companies based in the region are expanding their operations across Europe. One of the most critical financial tools for successful expansion is a Euro (EUR) business account. Whether you're trading with European partners, accepting payments from EU clients, or managing international payroll, opening a EUR account can offer substantial benefits for UAE-registered companies.

Why a UAE Company Needs a Euro Account

Here are the top reasons why your UAE business should consider a EUR account:

Eliminate currency conversion costs when transacting in euros

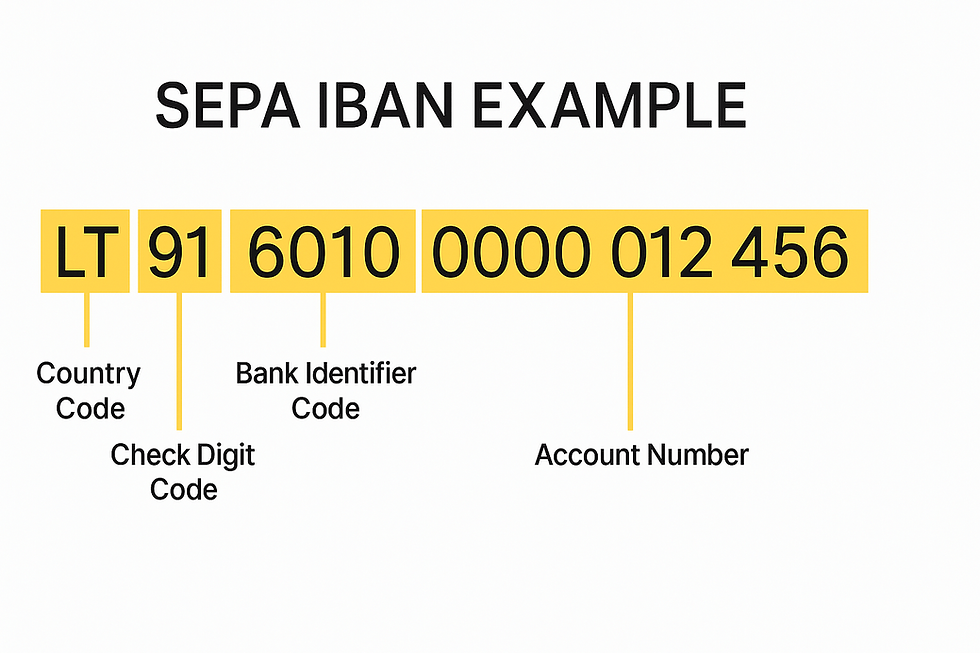

Speed up payments with SEPA (Single Euro Payments Area) transfers

Establish credibility with EU suppliers and customers

Improve control over your multi-currency cash flow

Reduce dependency on USD-only accounts

Whether you're in import/export, IT services, e-commerce, or professional consulting, having a EUR account can streamline your European business operations.

Can a UAE Company Open a Euro Account Abroad?

Yes. UAE companies can open EUR accounts both inside the UAE (via local banks offering multi-currency accounts) and abroad (in the EU or UK through international banks or fintech platforms).

There are three main options:

Multi-currency accounts with UAE banks (e.g., Mashreq, Emirates NBD)

International accounts with European banks or EMIs (e.g., Wise, Revolut)

Digital banks or fintechs offering EUR IBANs (e.g., Statrys, N26)

If you would like to get a full list of best digital banks and EMIs that open EUR accounts for UAE companies, fill out our contact form with your details and we will send it to you by email.

🌍 Where to Open a EUR Account for a UAE Company

Option | Pros | Cons |

UAE Traditional Banks | Regulated, physical presence | Slower onboarding, stricter KYC |

European Banks | Direct access to SEPA, ideal for EU clients | Often requires local entity or strong EU business case |

Fintechs / EMIs | Fast onboarding, remote setup, EUR IBAN | Not covered by full banking license (but still regulated) |

📋 Documents Required

To open a EUR business account for a UAE company, you’ll typically need:

🧾 Company Documents:

Valid trade license (Free Zone, Mainland, or Offshore)

Certificate of incorporation

Memorandum and Articles of Association

Shareholder registry and ownership structure

👤 Personal Documents:

Passport and Emirates ID of directors and UBOs (owners >25%)

Proof of address (utility bill or bank statement)

📂 Supporting Info:

Website and company profile

Business plan or explanation of operations

Sample invoices or contracts (especially with EU clients)

Source of funds and expected transaction volumes

Some fintechs may require enhanced due diligence for high-risk industries such as crypto, gaming, or logistics.

💳 Do You Get a Dedicated EUR IBAN?

Many fintech and EMI providers can issue dedicated EUR IBANs under your UAE company’s name. This is ideal for:

Accepting euro payments from customers

Registering on European marketplaces

Receiving funds via SEPA transfers

⚠️ Challenges to Expect

Opening a EUR account abroad as a UAE company can face the following roadblocks:

KYC complexity: Extra scrutiny due to international nature

Proof of EU business activity: Especially with EU/UK banks, FIntechs are more flexible

UBO transparency: Offshore or nominee structures may receive more scrunity

High-risk sectors: Fintechs are more friendly than traditional banks to crypto, adult, or gambling-related businesses

Prepare detailed, transparent documentation. Some providers may ask for video verification or notarized copies.

✈️ Can You Open the Account Remotely?

Yes — especially if you choose a fintech or EMI. Most reputable platforms support:

100% online application

Video KYC

Document upload portals

Support teams with experience onboarding UAE companies

Traditional banks in Europe or the UAE may require in-person visits or a local presence.

🔎 Best Fintechs for UAE Companies Needing a Euro Account

Provider | Features | Notes |

Wise Business | EUR IBAN, low FX rates, SEPA & SWIFT | Fast onboarding |

N26 | EUR & multi-currency accounts, cards | Great for e-commerce and freelancers |

Statrys | Dedicated account manager, EUR IBAN | Ideal for established SMEs |

Revolut Business | EUR + GBP, cards, accounting tools | May require EU address |

SWAN | Tailored to EU and offshore clients | More expensive, concierge service |

🧠 Expert Tips

Choose a provider with EUR IBANs under your company name (not pooled accounts)

Use a UAE Free Zone company with clear ownership for faster approval

Have a documented business case for EU transactions, even if you're remote

Work with a consultant if applying to banks directly

Final Thoughts

Opening a Euro (EUR) account for your UAE company is a smart step for any business with European exposure. Whether you go with a traditional bank, a digital platform, or an EMI, the key to success is preparation: clear documentation, transparency, and choosing the right provider based on your business profile.

By securing a EUR account, your company can save on currency conversion, build credibility in the EU, and streamline payments across Europe.