How to Open a SEPA Account With No Physical Address in Europe

- Epico Finance

- May 19, 2025

- 4 min read

Updated: Jun 26, 2025

Opening a SEPA (Single Euro Payments Area) account without a physical address in Europe is increasingly feasible, thanks to the rise of digital banking solutions. This guide provides a comprehensive overview of how non-residents can establish a SEPA account remotely, ensuring seamless euro-denominated transactions across Europe.

🌍 Understanding SEPA and Its Importance

SEPA is an initiative by the European Union to simplify and harmonize euro-denominated bank transfers across member countries. It enables individuals and businesses to make cross-border payments as easily as domestic ones, fostering economic integration. For non-residents, a SEPA account facilitates:

Efficient Euro Transactions: Enables smooth sending and receiving of euros across SEPA countries.

Cost-Effective Transfers: Reduces fees associated with cross-border payments.

Access to European Financial Services: Provides entry to a wide range of banking and financial services within Europe.

🌐 Use Cases for SEPA Accounts When You're Not Based in Europe

Opening a SEPA account without living in Europe can unlock a range of practical benefits for individuals and businesses alike. For example, freelancers and remote workers can receive euro payments from European clients at low cost and with faster settlement times.

E-commerce sellers and digital entrepreneurs using platforms like Amazon EU, Etsy, or eBay can streamline payouts in EUR without relying on expensive currency conversions.

For crypto traders or fintech startups, SEPA accounts make it easier to off-ramp stablecoins and euros from European exchanges like Bitstamp or Kraken.

Similarly, property investors or real estate agents who own or manage European assets can use SEPA accounts to collect rental income or pay local service providers.

Even international students or expatriates benefit by paying tuition or receiving family support in euros more conveniently.

🛠️ Steps to Open a SEPA Account Without a European Address

1. Choose a Digital Banking Provider

Several digital banks and Electronic Money Institutions (EMIs) offer SEPA accounts to non-residents:

Wise: Provides multi-currency accounts with local bank details in several countries, including the Eurozone.

Revolut: Offers personal and business accounts with SEPA capabilities.

N26: A German digital bank that allows non-residents to open accounts, though a European address may be required.

Monese: Caters to expatriates and offers SEPA accounts without the need for a European address.

If you would like to get a SEPA account providers list tailored to your specific situation, contact us and we will send it to you by email.

2. Prepare Necessary Documentation

While requirements vary by provider, common documents include:

Valid Passport or National ID: To verify your identity.

Proof of Address: Some providers may accept non-European addresses or offer alternatives like utility bills or bank statements.

Tax Identification Number: To comply with international tax regulations.

3. Complete the Application Process

Most digital banks offer an online application process:

Online Form: Fill out personal details and upload required documents.

Identity Verification: May involve a video call or submission of a selfie with your ID.

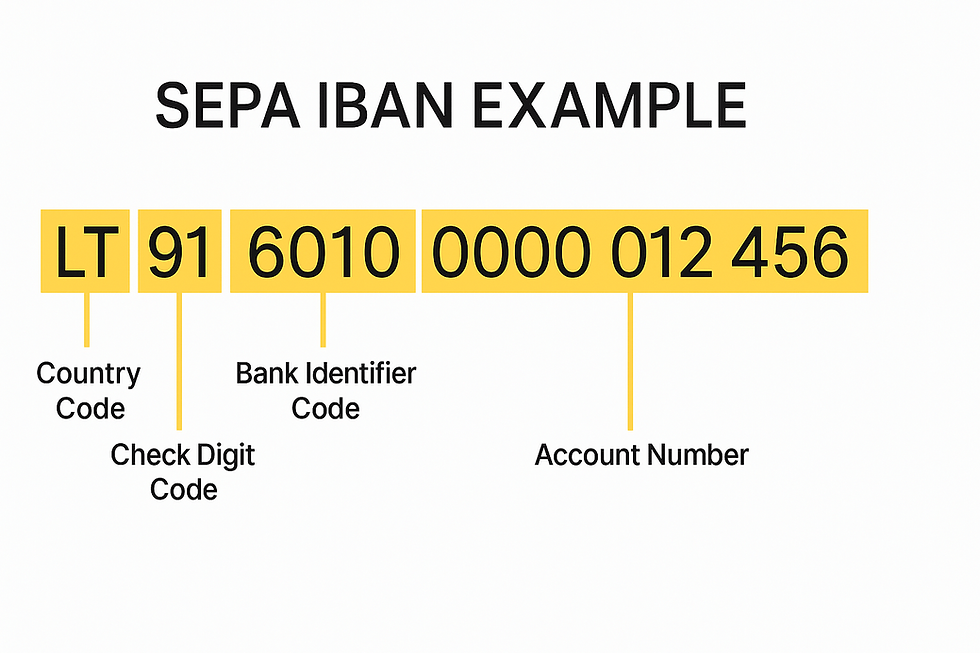

Account Approval: Once verified, you'll receive your IBAN and can start transacting.

⚠️ Considerations and Tips

Address Requirements: Some providers may require a European address for certain services, like card delivery. Consider using mail forwarding services if necessary.

Service Limitations: Be aware of any restrictions on account functionalities for non-residents.

Currency Exchange Fees: Understand the fees associated with currency conversions if you plan to transact in currencies other than euros.

❓ Frequently Asked Questions

Is it legal for foreigners or non-residents to have a SEPA account in Europe?

The answer is yes—it is absolutely legal. European financial institutions, particularly EMIs and fintech banks, are increasingly open to onboarding non-resident clients

Can I open a SEPA account online without visiting Europe?

Fortunately, the answer is also yes. Many digital banks offer remote onboarding with online identity verification, making it possible to open a SEPA-enabled IBAN account from anywhere in the world.

Will my SEPA account be flagged or closed for crypto-related transfers?

The answer depends on the provider. Traditional banks may flag or restrict crypto-related activity, but crypto-friendly EMIs can support such use cases—always check the provider’s crypto policy before onboarding.

Do I need a registered company in the EU to open a SEPA business account?

Not necessarily. While some institutions do require an EU-registered entity, many modern fintechs accept offshore or non-EU companies as long as the business activity is legal, verifiable, and not high-risk.

What are the risks of using a virtual IBAN from an EMI instead of a traditional bank? While virtual IBANs are fully functional and regulated under EU law, they may have certain limitations—like restricted SWIFT capabilities or no access to loans—compared to a full bank. However, they are often quicker to open, cheaper to maintain, and better suited to international digital businesses and freelancers operating remotely.

Conclusion

Opening a SEPA account without a physical address in Europe is achievable through various digital banking platforms. By selecting the right provider and preparing the necessary documentation, non-residents can access European financial services and conduct euro transactions with ease.