How to Automate Your FX Operations: A Comprehensive Guide for Businesses

- Epico Finance

- Sep 16, 2024

- 4 min read

Updated: Jul 28

Whether it's making payments to international suppliers, receiving funds from overseas clients, or managing investments in different currencies, foreign exchange is crucial for any global business.

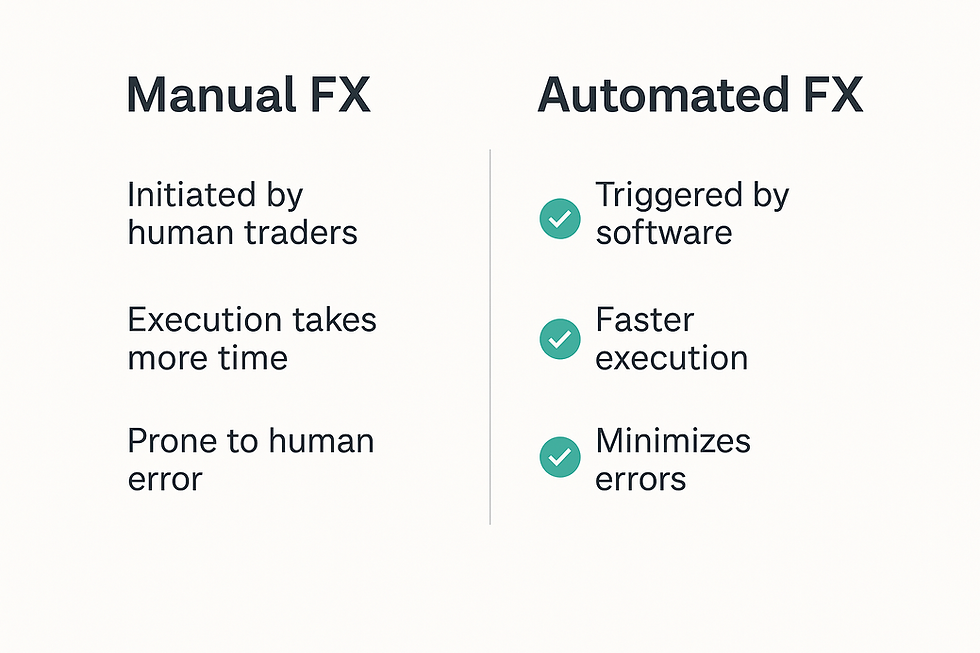

However, managing FX operations manually can become increasingly complex, especially with volatile currency markets. This is where automating FX operations comes into play.

Why Automate Your FX Operations? The Benefits for Businesses

Automating corporate FX operations provides businesses with several key advantages:

Efficiency and Speed: Automation ensures that FX transactions are processed quickly, eliminating delays associated with manual processing and enabling businesses to execute multiple transactions simultaneously.

Accuracy: Automation minimizes human errors, ensuring that exchange rates and transaction details are inputted accurately, saving businesses from costly mistakes.

Cost Savings: By reducing the need for manual intervention, businesses can lower operational costs, including those related to labor and errors.

Consistency: Automated processes ensure that trades are executed according to pre-set strategies, eliminating the risk of inconsistency from impulsive decision-making.

Risk Management: Automated FX systems allow businesses to track currency risks in real-time and implement automated hedging strategies to protect profits.

Let’s dive into how you can start automating your FX operations while still retaining control over critical aspects.

How to Identify FX Needs: A Step-by-Step Process

Before automating your FX operations, it's important to understand your business's unique foreign exchange flows. Consider the following:

Which currencies do you frequently deal with?

How often do you make international payments or receive foreign currency payments?

What is your average deal size in FX transactions and annual volumes?

How much exposure does your business have to currency fluctuations?

What are your current costs related to FX dealing and hedging?

Top FX Automation Tools for Businesses

Now that you've identified your FX needs, it’s time to choose the right automation tools. Several tools can simplify your corporate FX processes, and each one serves a different purpose:

1. Forward Contracts

Forward contracts allow businesses to lock in exchange rates for future transactions, minimizing the risk of currency fluctuations. Automating the execution of forward contracts ensures that businesses secure favorable rates without constant manual monitoring.

How Automation Helps: Automated systems can execute forward contracts at predetermined times, ensuring protection from volatility and hedging against currency risks well in advance.

2. Spot Transfers

Spot transfers involve immediate currency conversion and are ideal for businesses making urgent payments or overseas transfers.

How Automation Helps: Automating spot transfers ensures urgent payments are processed quickly, avoiding delays and human intervention.

3. Limit Orders

Limit orders let businesses set a target exchange rate for automatic execution when the market hits the desired rate. This strategy helps businesses optimize their FX strategy without constant monitoring.

How Automation Helps: Automated limit orders ensure transactions are executed when the market reaches the ideal rate, allowing businesses to take advantage of favorable exchange rates effortlessly.

4. Hedging Strategies

FX hedging tools protect businesses from adverse currency fluctuations. Automating hedging strategies, such as forward contracts and options, helps businesses maintain their desired risk profile.

How Automation Helps: Automated hedging tools track exposure and execute trades to protect against currency risks, ensuring businesses stay within their risk tolerance.

5. Bulk Payments

For businesses handling multiple international transactions, bulk payment tools allow for the simultaneous conversion and transfer of payments across currencies, streamlining processes and reducing costs.

How Automation Helps: Automating bulk payments ensures businesses can process multiple transactions efficiently, saving time and minimizing errors.

If you need up-to-date recommendations on the best FX providers that have above mentioned automation tools, fill out our contact form, and we’ll send personalized information based on your business’s currency needs.

Incorporating Real-Time Data and Analytics into FX Operations

While automation optimizes your FX operations, integrating real-time data and analytics is key to ensuring visibility over your trades and market movements. This will allow you to:

Track market conditions and adjust your strategies in real time.

Receive alerts when key market events occur.

Monitor the performance of your automated trades and hedging strategies.

Combining Automation with Human Expertise: Best Practices

While automation delivers speed and precision, human oversight remains essential. A well-rounded FX strategy combines the automation of routine tasks with the insights of experienced traders who can provide market analysis and strategy recommendations.

Continuously Monitor and Optimize Your FX Operations

Once your FX automation system is in place, ongoing monitoring and optimization are critical to ensuring efficiency. Regularly assess your automated transactions to:

Identify inefficiencies.

Adjust strategies based on market changes.

Ensure risk management tools are functioning effectively.

By constantly refining your FX operations, your business will stay ahead of currency risks and market fluctuations, making the most of automation benefits.

Conclusion

Automating your corporate FX operations offers substantial benefits, from increased efficiency and cost savings to better risk management. However, to maximize the potential of automation, businesses should combine automated tools with human expertise and constant monitoring. By doing so, your business can stay ahead of market shifts and ensure smooth, efficient FX operations.