How International Companies Can Get a Local Swiss IBAN Easily

- Epico Finance

- Apr 3, 2025

- 3 min read

Updated: Jun 28, 2025

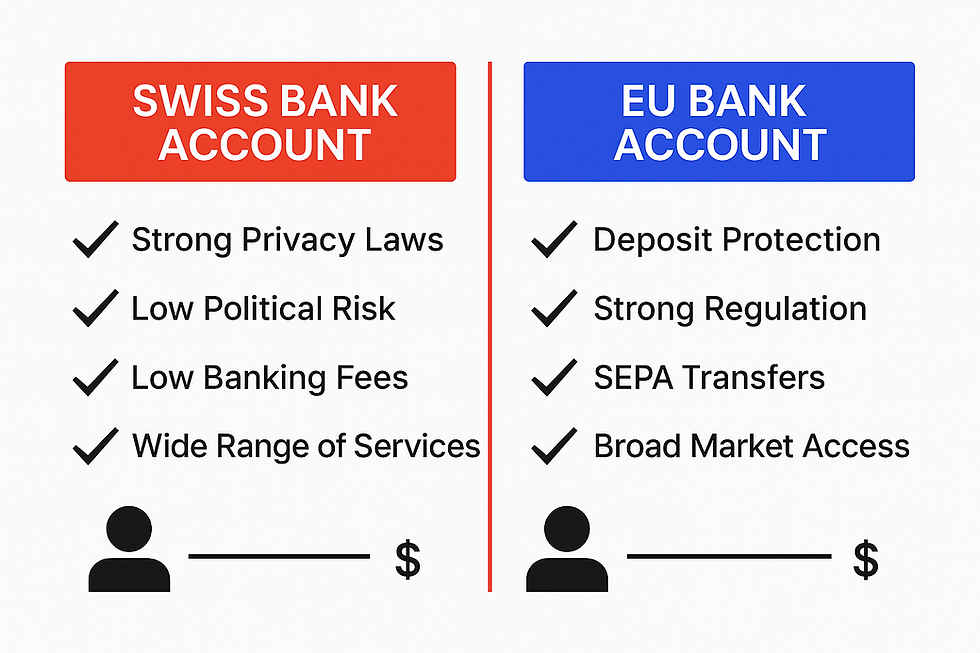

Switzerland is one of the most sought-after jurisdictions for international business banking. Whether you're operating in e-commerce, fintech, asset management, or global trade, having a dedicated local Swiss IBAN can enhance transaction speed, trust, and financial credibility. However, opening a Swiss IBAN—especially for non-resident or international businesses—requires the right approach.

What Is a Swiss IBAN?

An IBAN (International Bank Account Number) is a standardized format used to identify bank accounts internationally. A Swiss IBAN starts with the country code CH and is issued by a financial institution located in Switzerland.

A dedicated Swiss IBAN means the IBAN is exclusively assigned to your business, not shared with others—this is crucial for incoming payments, client confidence, and compliance.

Why Your Business Needs a Local Swiss IBAN?

Having a Swiss IBAN isn't just about prestige—it brings tangible financial and operational benefits, including:

Faster SEPA and SWIFT Payments

✔ Payments within Europe are processed more efficiently

✔ Reduces rejection of transfers from clients or partners who require local IBANs

Trusted Reputation

✔ Swiss banks are globally respected for stability, privacy, and compliance

✔ Helps businesses build credibility with partners and investors

Multi-Currency Capabilities

✔ Many Swiss business accounts allow CHF, EUR, USD, and GBP support

✔ Simplifies cross-border trade and FX management

Strong Banking Infrastructure

✔ Swiss banks are known for security, compliance, and long-term reliability

✔ Swiss banks are know for strong privacy features

Who Can Apply for a Swiss IBAN?

Eligibility depends on your business type, industry, and structure. In general:

Swiss companies (GmbH, AG) can apply directly

EU and international businesses can apply via fintech or EMI platforms

High-risk businesses (crypto, gambling, forex) may require specialized providers

If you would like to get an up to date list of best digital banks for international company or high-risk business, fill out our contact form with your details and we will send it to you by email.

Required Documents to Open a Swiss IBAN Account

To open a business account with a Swiss IBAN, you typically need:

Certificate of incorporation

Company structure and ownership chart

KYC documents of directors and shareholders

Description of business activity

Proof of source of funds or expected transaction volumes

The stronger your compliance and documentation, the smoother the onboarding.

How to Get a Dedicated Swiss IBAN?

There are two main options:

1. Traditional Swiss Banks

✔ High levels of credibility

✔ Full banking services, including loans, FX, and investments

✔ Suitable for medium-to-large companies or Swiss-domiciled entities

Examples:

Credit Suisse

UBS

PostFinance

Banque Cantonale Vaudoise

However, the traditional banks may not support non-resident or high-risk sectors.

2. EMIs and Fintech Platforms (with Swiss IBANs)

✔ Fast online onboarding

✔ Dedicated local CH IBANs via partnering banks

✔ Lower fees and minimum deposit requirements

✔ Ideal for international businesses, freelancers, or crypto-friendly firms

If you would like to get a list of top Swiss Fintechs with CH IBAN, contact us.

Things to Consider When Choosing a Provider

Before selecting a provider, assess the following:

Feature | Why It Matters |

CH IBAN Type | Ensure it's dedicated, not a pooled/shared IBAN |

Multi-currency support | Especially if your business receives USD/EUR |

Payment network access | SEPA and SWIFT compatibility is essential |

Industry acceptance | Check if your sector is supported (e.g., crypto, gaming) |

Online banking tools | Useful for day-to-day transaction management |

Benefits of Using Swiss IBAN for International Payments

✅ Accept client payments globally without raising compliance flags

✅ Send and receive funds via SEPA & SWIFT

✅ Avoid delays and blocked transactions from banks that require same-country IBANs

✅ Lower FX costs by holding multiple currencies in the same account

Conclusion

Getting a dedicated local Swiss IBAN can open new financial and business opportunities—especially for companies that require international trust, banking precision, and payment reliability. Whether you're a Swiss-registered firm or a global business seeking a prestigious account for international operations, there are multiple routes to secure one.