How Fintechs and Financial Institutions Can Leverage eIDs

- Epico Finance

- Jul 8, 2025

- 3 min read

Starting May 2026, the European Union will mandate the use of digital identity wallets, or eIDs, across all member states. This represents a transformative shift for fintechs and financial institutions (FIs), offering both compliance challenges and significant opportunities for efficiency and innovation.

What Are eIDs?

eIDs, or electronic IDs, are secure digital wallets issued by governments to citizens and residents. These wallets store personal identification information such as name, date of birth, and address, and may include verified data like bank accounts, qualifications, and even driving licenses. eIDs enable individuals to identify themselves online with a high degree of trust and authentication.

As part of the EU's broader strategy for digital sovereignty and single market efficiency, eIDs aim to provide a unified, interoperable system for digital identification across borders and services.

Regulatory Context: EU Digital Identity Framework

The revised eIDAS 2.0 Regulation mandates that every EU citizen and resident must have access to an eID by May 2026. This regulation is intended to foster a harmonized digital identity system across Europe, enabling users to access public and private sector services securely.

Key obligations for fintechs and FIs include:

Accepting government-issued eIDs for onboarding.

Integrating with national and cross-border eID systems.

Ensuring GDPR-compliant processing of eID data.

How Fintechs Can Leverage eIDs

Fintechs, often at the forefront of digital innovation, stand to benefit greatly from the eID mandate. Here are several practical applications:

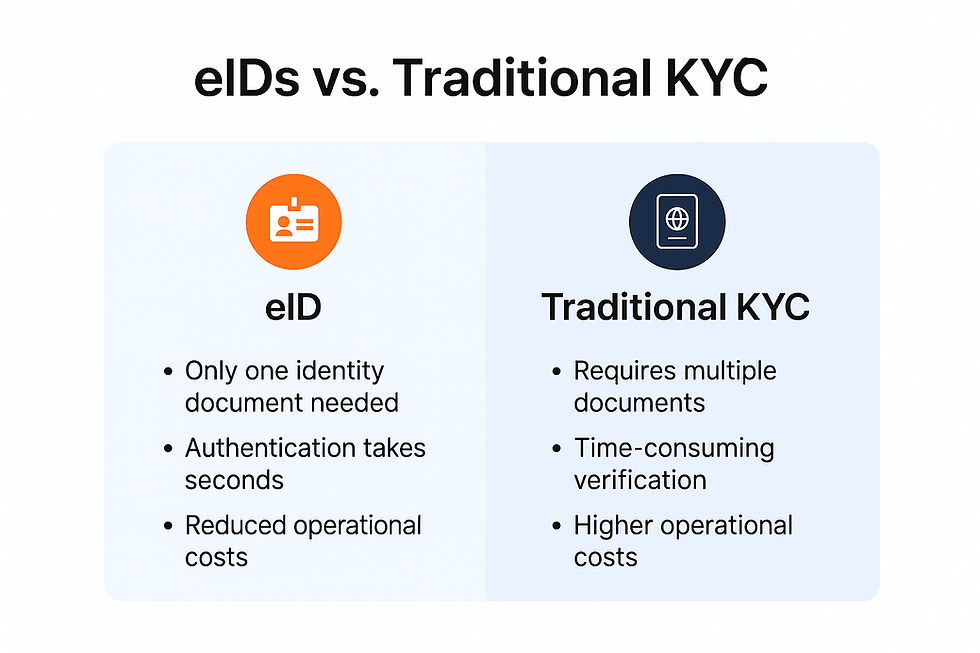

Streamlined KYC and Onboarding: With access to verified digital identity data, fintechs can automate the KYC process. This eliminates the need for manual document uploads and verification, accelerating onboarding and improving conversion rates.

Example: A neobank can allow users to sign up using their eID wallet. Once authorized, the system fetches verified identity data, completing KYC within seconds.

Improved Fraud Prevention: eIDs provide a higher level of identity assurance, helping fintechs reduce identity fraud and impersonation. Real-time verification reduces risks associated with synthetic identities.

Cross-Border Expansion: As eIDs are interoperable across the EU, fintechs can easily expand services to new countries without redesigning compliance workflows for each jurisdiction.

Example: A crypto exchange operating in Germany can onboard clients from France or Italy seamlessly via eID authentication.

Seamless Access to Financial Services: eIDs allow customers to prove identity, age, and residency with a single digital wallet, simplifying access to loans, trading platforms, or investment tools.

Integration with Smart Contracts and Web3: Some fintech innovators are exploring how eIDs can validate user identities in DeFi platforms or smart contract-based services.

How Financial Institutions Benefit from eIDs

Traditional banks and financial institutions, while often slower to adopt technology, will see cost and efficiency benefits:

Reduction in KYC Costs: KYC processes are notoriously expensive, often costing between €20 to €100 per client. eIDs can reduce this significantly by automating identity checks and document collection. If you'd like to explore eIDs and KYC cost reduction with it, contact us for a list of the best eID providers.

Enhanced Customer Trust: Using government-issued credentials boosts trust in the verification process and aligns with regulatory standards.

Better Customer Retention: Simplified digital experiences can reduce customer churn and encourage product adoption.

Regulatory Compliance: eIDs will be considered a compliant form of ID under AMLD6 (Anti-Money Laundering Directive), ensuring FI onboarding meets EU requirements.

Reduced Operational Complexity: Banks can consolidate disparate ID verification systems into a single, secure integration.

Real-World Example: eID Use in Estonia

Estonia has long been a pioneer in digital identity. Through its national eID program, citizens can access banking, tax, health, and government services online.

Fintechs operating in Estonia report up to 70% reductions in onboarding costs and near-instant verification. This success story foreshadows what the broader EU market could experience starting in 2026.

Challenges and Considerations

While eIDs offer numerous advantages, fintechs and FIs must address certain challenges:

Technical Integration: Connecting legacy systems with eID frameworks will require development and testing.

Data Security: Handling government-issued ID data places a high burden on secure processing and GDPR compliance.

User Adoption: Educating customers on using eIDs will be critical, especially in less digitally mature markets.

Vendor Dependency: Many fintechs may rely on third-party providers to bridge integrations, adding cost and dependency risks.

Future Outlook

As eIDs become the standard across the EU, we can expect:

New fintech products tailored to eID-based authentication.

Standardized APIs and frameworks for easy integration.

Cross-border partnerships fueled by seamless identity verification.

Greater inclusion of underserved populations with limited access to physical identity documents.

If you would like to get an up to date list of best eID's service providers, fill out our contact form and we will send it to you by email.

Conclusion

The mandatory rollout of eIDs across the EU by May 2026 represents a monumental shift for financial services. Fintechs and financial institutions that act early to integrate eIDs will enjoy lower KYC costs, better compliance, faster onboarding, and enhanced trust.