Digital Banking Solutions For Payment Institutions (PSPs)

- Epico Finance

- Dec 6, 2024

- 4 min read

Updated: Jul 7, 2025

The rapid evolution of digital banking is reshaping the financial landscape, and payment institutions (PSPs) are among the biggest beneficiaries of this transformation. Traditional banking has often posed challenges for PSPs, such as compliance hurdles, lengthy account opening processes, and high fees. Digital banking solutions are stepping in to bridge these gaps, offering PSPs innovative ways to manage client funds, streamline settlement operations, and enhance efficiency.

What Are Digital Banking Solutions?

Digital banking solutions refer to financial services provided through online platforms or mobile apps without the need for physical branches. These solutions are powered by fintech companies, challenger banks, or traditional banks that have embraced modern technologies.

For PSPs, digital banking solutions include:

Multi-Currency Accounts: Enabling seamless cross-border transactions.

Automated Payment Processing: Facilitating faster settlements for merchants and clients.

Integration Capabilities: Connecting banking functions with PSP platforms for real-time operations.

Compliance Tools: Simplifying AML (Anti-Money Laundering) and KYC (Know Your Customer) processes.

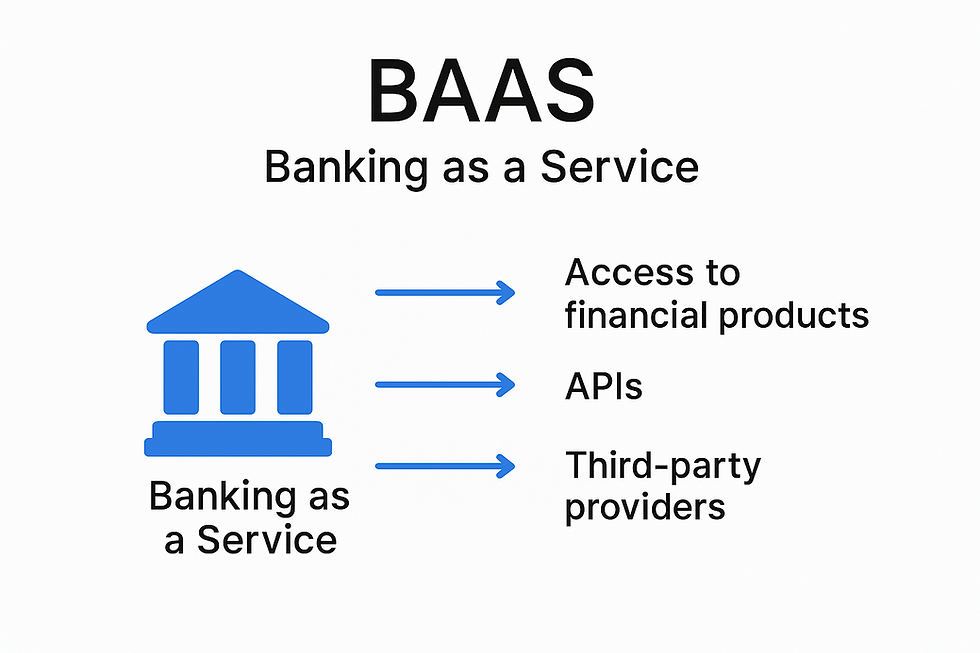

BaaS: allowing PSPs to issue individual named account IBANs to their end clients.

Why PSPs Are Turning to Digital Banking Solutions

1. Overcoming Traditional Banking Challenges

Traditional banks often categorize PSPs as high-risk clients due to the nature of their operations. This can lead to:

Lengthy account opening procedures.

High fees for transactions

Strict ompliance checks.

Limited access to real-time financial tools.

Periodic operation and compliance audits

High monthly or quarterly minimum fees

Constant requests of additional documents

Digital banking solutions address these issues by offering faster onboarding, lower fees, and specialized services tailored for PSPs.

2. Supporting Cross-Border Transactions

PSPs frequently handle international payments, requiring multi-currency support and efficient exchange rate management. Digital banks provide bespoke and competitive forex rates, multi-currency accounts, and wide cross-border rail networks, making them ideal partners for PSPs.

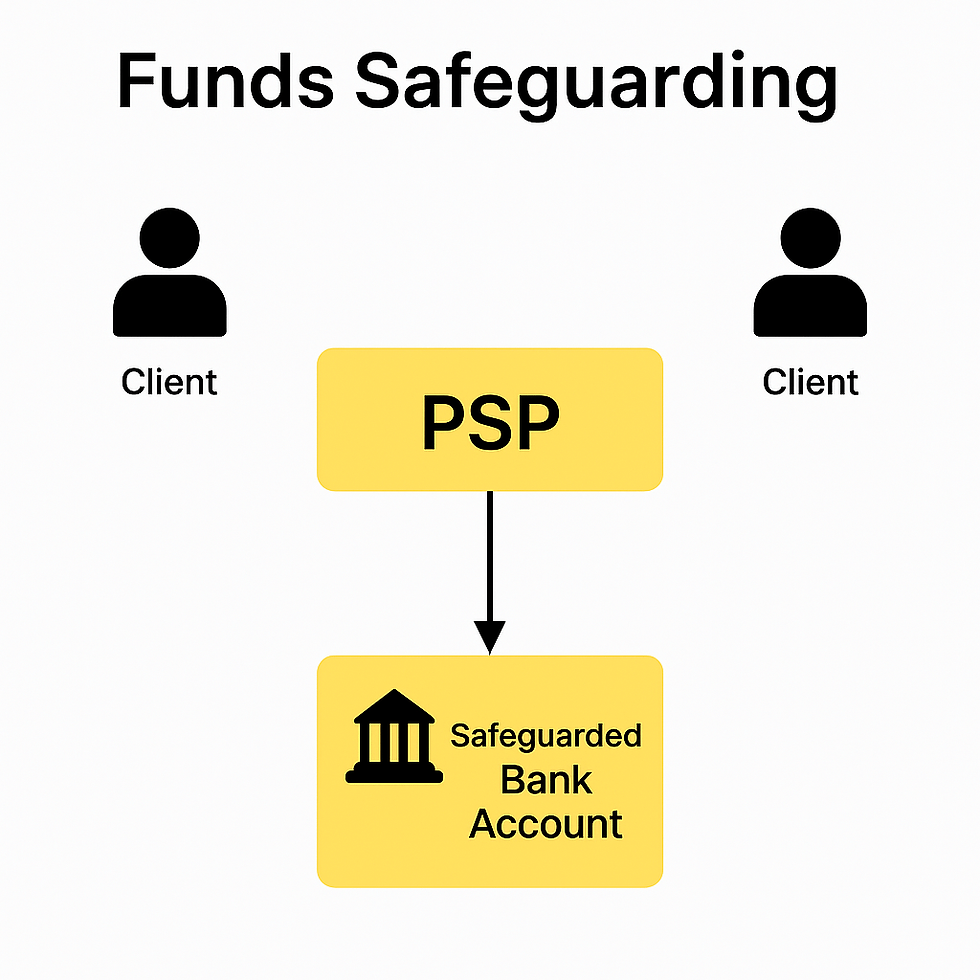

3. Enhancing Client Money Safeguarding

Regulations like PSD2 in the EU require PSPs to segregate client funds from operational funds. Digital banking platforms often offer segregated accounts with built-in compliance features, ensuring PSPs meet regulatory requirements while safeguarding client money.

4. Streamlining Settlement Operations

Settlement operations are critical for PSPs, and delays can harm client relationships. Digital banks offer faster payment processing, often leveraging instant payment systems like Faster Payments in the UK or SEPA Instant in the EU.

Key Features of Digital Banking Solutions for PSPs

1. Multi-Currency Accounts

Handling transactions in different currencies is a core function for PSPs. Digital banks provide multi-currency accounts that allow PSPs to:

Accept payments in multiple currencies.

Hold balances without immediate conversion.

Minimize exchange rate losses.

Increase payment settlement times.

Issue sub-accounts for their end clients.

2. Automated Reconciliation

Reconciliation of accounts is a time-intensive task for PSPs. Digital banking platforms integrate with accounting software to automate reconciliation, reducing errors and saving time.

3. Advanced Security and Fraud Prevention

Digital banks leverage AI and machine learning to detect fraudulent activities and enhance transaction security. These tools help PSPs comply with AML regulations and protect client funds.

4. API Integrations

Digital banking platforms often provide APIs that enable PSPs to:

Integrate banking features into their own systems.

Automate workflows like payouts and settlements.

Access real-time data for better financial management.

5. Lower Costs

Compared to traditional banks, digital banks often charge lower fees for:

Account maintenance.

International transfers.

Transaction processing.

Currency exchange.

Account creation.

This makes them cost-effective for PSPs managing high transaction volumes or handling large volumes of merchant payments.

Benefits of Digital Banking for PSPs

1. Faster Onboarding

Digital banks streamline the account opening process with online applications and cater to onboarding financial institutions such as PSPs, reducing the time it takes for PSPs to get started.

2. Real-Time Insights

With advanced analytics and dashboards, digital banks empower PSPs to monitor transactions, manage liquidity, and forecast financial performance.

3. Improved Scalability

Digital banking solutions are highly scalable, accommodating the growth of PSPs without requiring significant changes to their financial infrastructure. A single API integration can automate a significant part of PSPs operation workflows.

4. Compliance Made Easy

Built-in compliance tools ensure that PSPs adhere to regulations like AML, KYC, and PSD2. Automated reporting features reduce the administrative burden.

Challenges to Consider

While digital banking offers numerous benefits, PSPs should be aware of potential challenges:

Regulatory Variations: Ensure the digital bank complies with regulations in your operating regions.

Limited Services: Some digital banks may lack advanced features like loans or credit facilities.

Dependence on Technology: Outages or technical issues could disrupt operations.

How to Choose the Right Digital Banking Solution

When selecting a digital banking platform, PSPs should consider:

Regulatory Compliance: Ensure the platform supports compliance with local and international regulations.

Integration Capabilities: Look for APIs and tools that integrate with your existing systems and allows easy scalability.

Cost Structure: Compare fees for minimum monthly commitments, transactions costs that can be fixed or percentage based, and forex mark-ups.

Customer Support: Opt for platforms with reliable and accessible support teams or dedicated auccount managers.

Scalability: Choose a solution that can grow with your business with payment rails and modern APIs.

If you would like to get an up to date list of best digital banks for PSPs globally, fill out our contact form with your details and we will send it to you by email.

Conclusion

Digital banking solutions are transforming the way payment institutions manage client funds and settlements. By leveraging features like multi-currency accounts, automated reconciliation, and advanced security, PSPs can enhance efficiency, reduce costs, and comply with complex regulations. As the digital banking landscape continues to evolve, PSPs must carefully evaluate their options to select the best platform for their unique needs.