Best Crypto On-ramp and Off-ramp Practices and Banking Providers [Full Guide]

- Epico Finance

- Feb 25, 2024

- 5 min read

Updated: Sep 2, 2025

In the rapidly evolving digital asset space, the bridge between traditional finance (TradFi) and decentralized finance (DeFi) is crucial for the seamless flow of value. This guide explores the best practices and banking providers for crypto on-ramping and off-ramping, offering businesses and individuals insights into navigating the complexities and risks associated with these processes efficiently.

Understanding On-ramps And Off-ramps

On-ramps and off-ramps are integral to the crypto ecosystem, acting as gateways between fiat currencies and cryptocurrencies. On-ramps facilitate the conversion of fiat to crypto, allowing users to enter the crypto market, while off-ramps enable the conversion of crypto back to fiat, providing a way to exit the market or realize gains in a spendable form.

Methods for On-Ramping and Off-Ramping in the Crypto Ecosystem

1. Centralized Stablecoins

Centralized stablecoins, such as USDC by Circle or USDT by Tether, are pegged to fiat currencies like the USD and issued by regulated (or semi-regulated) entities. They are widely adopted for enterprise-level crypto transactions, particularly in cross-border settlements where stability and predictable pricing are critical.

For example, a Singapore-based exporter receiving payment in USDC can quickly convert it to local currency via a compliant off-ramp partner, avoiding volatility risks associated with Bitcoin or Ethereum. Their broad acceptance across payment processors, exchanges, and DeFi platforms makes them a practical choice for both corporate treasuries and merchant settlements.

2. Decentralized Stablecoins

Decentralized stablecoins, such as DAI (backed by overcollateralized crypto assets) or newer algorithmic models, are minted via smart contracts without reliance on a central issuer. They offer borderless accessibility, making them valuable in markets where banking infrastructure is limited or restricted.

For instance, a freelancer in Nigeria could be paid in DAI through a Web3 payments platform, retaining value in a stable form without needing a local bank account. However, these assets carry inherent risks—such as the collapse of algorithmic pegs (e.g., the TerraUSD case)—which require users to monitor collateral ratios and protocol governance carefully.

3. Centralized Exchanges (CEXes)

Platforms like Binance, Coinbase, and Kraken allow users to deposit a variety of fiat currencies—via bank transfers, cards, or payment gateways—and purchase crypto assets or stablecoins directly. For off-ramping, these exchanges provide fiat withdrawal options back to bank accounts in supported jurisdictions.

A small business in London, for example, could receive payments in Bitcoin, convert them to GBP via Coinbase, and withdraw to its corporate account within a day. While CEXes offer convenience and deep liquidity, they can involve higher transaction fees, withdrawal limits, and the risk of frozen accounts due to compliance reviews.

4. Service Providers & OTC Desks

Specialized service providers, including non-bank financial institutions (NBFIs), payment processors, and OTC trading desks, focus on high-volume or custom settlement needs. OTC desks are especially useful for large transactions that might move market prices if done on open exchanges.

For instance, a crypto hedge fund cashing out millions in USDC could use an OTC desk to settle directly into EUR with minimal slippage. These providers may also integrate with corporate banking infrastructure, but fees and settlement times can vary depending on jurisdiction, counterparties, and risk profiles.

5. Digital Banks & Electronic Money Institutions (EMIs)

A growing number of digital banks and EMIs in Europe, the UK, and certain parts of Asia are integrating crypto-friendly services into their offerings. While they may not directly handle cryptocurrencies on-chain, they partner with regulated VASPs (Virtual Asset Service Providers) to facilitate compliant fiat conversions.

For example, a crypto business in Lithuania could receive USDT via a partnered VASP, which instantly settles the equivalent EUR into their EMI account via SEPA Instant. These institutions often provide multi-currency IBANs, integrated treasury tools, and interest-bearing accounts—making them attractive for businesses seeking both operational banking and a regulated off-ramp. If you would like to get an up to date list of best digital banks for crypto on/off ramps, fill out our contact form and we will send it to you by email.

Best Practices for On/Off Ramping

Navigating the on/off ramping process successfully requires a clear operational strategy, risk awareness, and the right combination of providers. By understanding your specific needs and building a diversified approach, you can protect liquidity, reduce exposure to single points of failure.

1. Map Out Your On/Off-Ramp Requirements

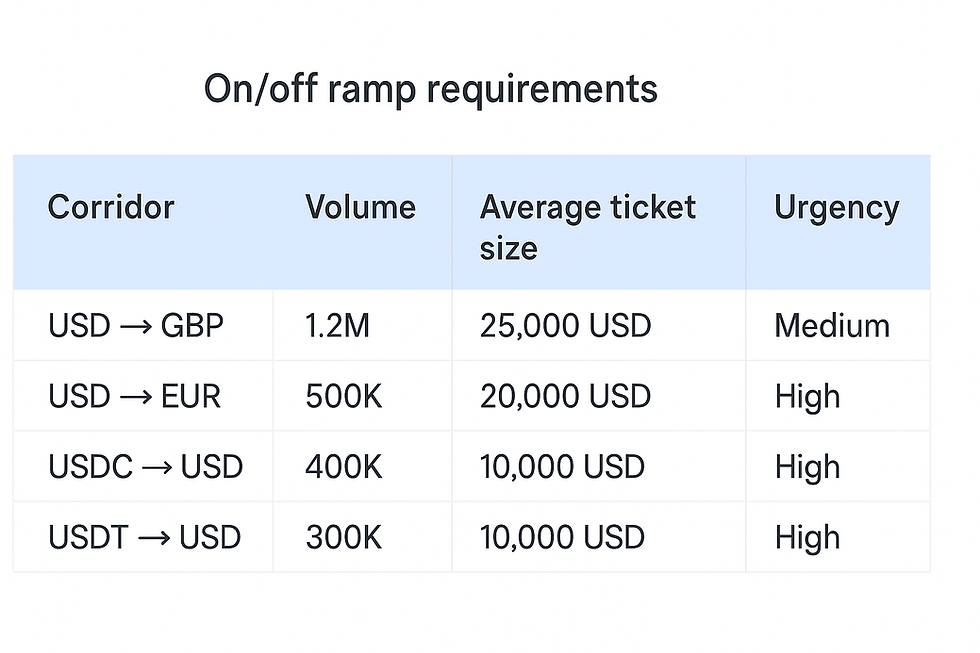

Before selecting a provider, identify your payment corridors—the country pairs and fiat flows you deal with most often. Map the monthly volume, currency pairs, and transaction types (e.g., payroll, vendor settlements, customer withdrawals).

For example, a crypto OTC desk in London regularly paying vendors in Singapore in SGD should prioritize ramps that support GBP→SGD conversions with instant settlement. Having this data ready also streamlines due diligence conversations with providers, allowing you to negotiate pricing and service-level agreements based on actual transaction volumes.

Create a simple spreadsheet with your top 5 corridors, volumes, average ticket sizes, and urgency requirements, then filter ramping providers by their coverage.

2. Separate Treasury From On/Off Ramp Operations

Avoid using third-party custodial wallets—such as those offered by exchanges or payment gateways—as your primary treasury solution. This limits your exposure to counterparty risk, such as platform insolvency or frozen withdrawals. Instead, use self-custodial wallets (hardware or multisig) for storing the majority of your funds, and only move operational liquidity into ramping channels when needed.

3. Implement a Proactive Monitoring System

Stablecoins and other crypto assets carry liquidity and peg risks that can unfold rapidly. Set up alerts for social media mentions, blockchain activity spikes, and market price deviations. Tools like Nansen, Glassnode, or even custom Google Alerts can help you track events such as USDC briefly de-pegging during a banking crisis. For centralized stablecoins, review their attestation reports and reserve audits on a monthly basis, and for decentralized stablecoins, monitor collateral ratios on-chain.

4. Diversify Your On/Off Ramp Channels

Never rely on a single provider or method for converting between fiat and crypto. Build redundancy by incorporating multiple, uncorrelated channels—such as a centralized exchange account, an EMI partnership, and an OTC desk relationship—so that if one channel experiences downtime or compliance delays, your operations remain uninterrupted.

Treat your on/off-ramping strategy as part of your core financial infrastructure, not just a payment function.

How to Choose the Best Banking Partner for Crypto On/Off-Ramps

Selecting the right banking provider for your crypto on-ramping and off-ramping needs can make the difference between smooth operations and costly delays.

1. Integration With Crypto Services

Choose banks or EMIs that offer direct integration with crypto exchanges, OTC desks, and wallets. This reduces friction, shortens settlement times, and cuts transaction costs. Before onboarding, request a list of the bank’s integrated VASP and payment partners to confirm coverage for your corridors.

2. Regulatory Compliance

Ensure your provider is licensed in its operating jurisdiction and aligned with both local and international regulations. This helps safeguard your business from unexpected account freezes or service terminations. Ask for proof of licensing and verify it against the regulator’s public register before moving funds.

3. Fees and Transaction Limits

Review the bank’s complete fee schedule, including crypto-fiat conversions, FX spreads, and withdrawal charges. Also check daily, monthly, and per-transaction limits—these can bottleneck operations. Negotiate higher transaction limits during onboarding if your business handles large-volume payments.

4. Security Measures

Your banking partner should use strong encryption, multi-factor authentication, fraud monitoring, and segregation of client funds. Request documentation on security protocols and ask how they protect funds in the event of insolvency.

5. Customer Support

Reliable, responsive customer support can prevent small issues from escalating into operational blockages.Test the responsiveness of your provider’s support before committing—send a query and measure response times.

6. Interest on Fiat and Crypto Balances

Some modern EMIs and digital banks now pay interest on both fiat and stablecoin balances, turning idle funds into a revenue stream. Ask providers about interest rates, eligible currencies, and payout schedules; keep reserves in these accounts while maintaining separate operational wallets.

Conclusion

Navigating the world of crypto on-ramping and off-ramping is a critical aspect of engaging with the digital asset market. By understanding the different methods available, implementing best practices, and carefully selecting banking providers, businesses and individuals can optimize their strategies for entering and exiting the crypto space.